Land Market Value means the value of land as per the records mentioned by the Government of specific state. Land market Value is also known as Circle rate. Land market Valuation can be checked through online from the official website of the Land Department of the respective state govt.

Also Read – ট্রেড লাইসেন্স অনলাইনে কিভাবে রিনিউ করবেন – এখানে দেখুন.

Records are handled and maintained by Department of Stamps and Registration of each state. This records can be guidance value or land value of the properties every year.

Table of Contents

কিভাবে পশ্চিমবঙ্গের জমির বর্তমান মার্কেট দাম বা রেট জানতে পারবো?

পশ্চিমবঙ্গের যেকোনো জমির মার্কেট ভ্যালু আপনারা অনলাইনে চেক করতে পারবেন। আপনারা কম্পিউটার থেকে অথবা আপনাদের মোবাইল থেকেও জমির বর্তমান মার্কেট দাম জানতে পারবেন।

যেকোনো জমির মার্কেট ভ্যালু জানার জন্য আপনাকে পশ্চিমবঙ্গ রেজিস্ট্রি ডিপার্টমেন্টের ওয়েবসাইটে যেতে হবে, এই ওয়েবসাইটটি হল www.wbregisration.gov.in.

আপনারা এই ওয়েবসাইটের মাধ্যমে যেই জিনিস গুলো জানতে পারবেন সেগুলি হল:

| 1 | জমির বাজার মূল্য (Land Market Value) |

| 2 | ফ্ল্যাট/অ্যাপার্টমেন্টের বাজার মূল্য (Flat Market Value) |

| 3 | কাঠামো সহ জমির বাজার মূল্য (Land Value with Structure) |

| 4 | কোন জমির স্ট্যাম্প ডিউটি এবং রেজিস্ট্রেশন ফি |

কোন জমির বাজারমূল্য জানার জন্য আপনাকে যে সমস্ত তথ্য দিতে হবে সেগুলি হল:

- Plot নাম্বার,

- খতিয়ান নম্বর,

- জমির ঠিকানা – মৌজা, জেলা,

- জমির পাশে রাস্তা আছে কিনা,

- কত ফুট চওড়া রাস্তা আছে,

- রাস্তা পাকা না কাঁচা,

- জমির Lease রয়েছে কিনা,

- জমির কোনদিকে রাস্তা আছে,

- জমির প্রকার ইত্যাদি.

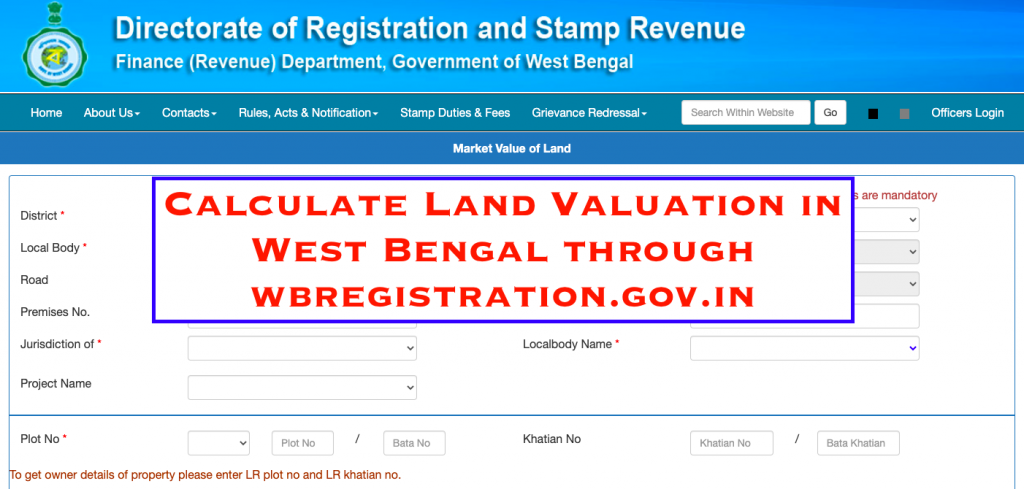

How to calculate Market Value of land in West Bengal online at wbregistration.gov.in?

Step 1: Firstly, Applicant should visit www.wbregistration.gov.in and then click on the link “Calculator for MV, SD and RF”.

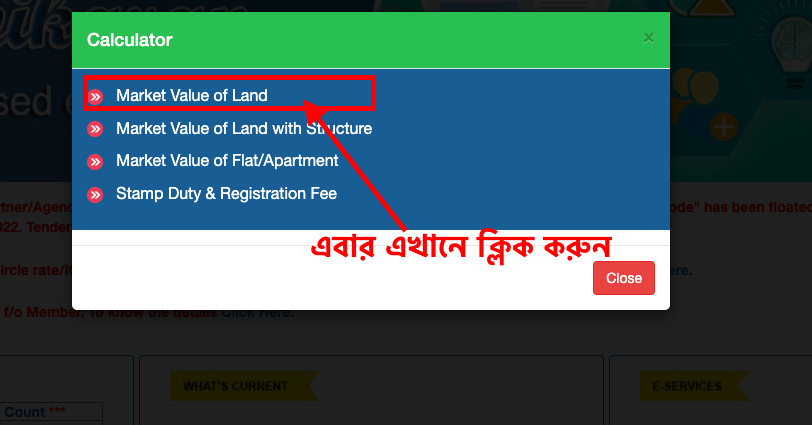

Step 2: This will lead to a splash window for selecting the Market value for the buyers where you will get following options:

- Market Value of Land,

- Market Value of Land with Structure,

- Market Value of Flat / Apartment,

- Stamp Duty & Registration Fee.

Now applicant need to select “market value of land” and this will lead to a new page.

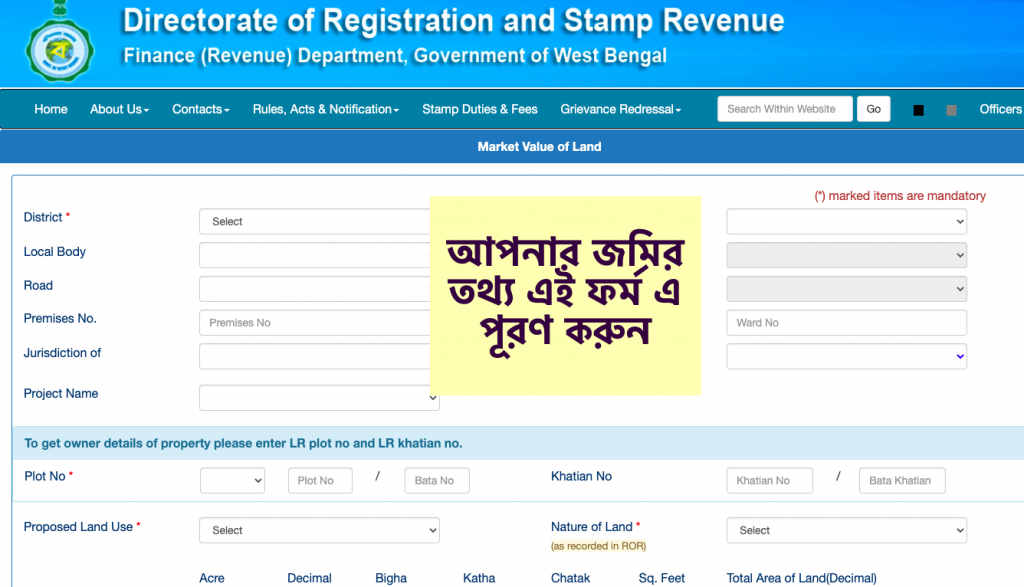

Step 3: After that Buyers should select from the provided options or enter specific value in the land which should be purchased.

Step 4: After completing all the procedures and applying the required values click on the link “Display Market value”.

Step 5: This will lead to a page where all the important details brought from the database along with the plot of land and the Market value of the property in INR will be shown.

Land Valuation in West Bengal

Directorate of Registration & Stamp Revenue under Finance Department, Govt of West Bengal provides the facility to the public for checking the present valuation of a piece or land or land with structure and Flats / Apartments. One user can easily Calculate the Market Value (MV), Registration Fees (RF) & Stamp Duty (SD) from the department’s official website www.wbregistration.gov.in.

You have to provide your LR Khatian Number, Plot Number, Mouza, Districts and other details to check your Land Valuation. If you don’t know your Plot No or Khatian Number, then check this article on how to find RS-LR Plot Information, Khatian Number through BanglarBhumi Portal.

Who decides the Market Value of a Land or Property?

The value of land and market stated by Department of Stamps and Registration changes yearly and from locality to locality. Its also said that market value will change between different construction within the same area or locality.

Market Value of a Land or Property

Guidance value or Market Value is one of the best and Lucrative revenue line for the State Government, but that doesn’t mean that Guidance value will always increase. The changes in Guidance Value will clearly and directly put a impact on a Property value. If there is a Higher Guidance value then Value of Property will also automatically increase by its own.

If there is any loss or downfall of Guidance value then Value of Property will also face the consequences. Also, Department of Stamps and Registration keeps a very close circle rate of a property as close to widespread market rates. This action will stop transaction of black money which will lead to the downfall of the revenue to the state. In some part of the country State Government impose the taxes on the basis of Guidance Value of the property.

Other Names of Land Value

The term Guidance Value is used and understood by every people out there. But there is other Alternative name used to refer to the Guidance Value, such as Market value, Guideline Value Ready Reckoner or RR rate which is the term mostly used by Maharashtra. The term Circle rate is widely used by North India and cities like Delhi and Noida.

Important facts regarding Calculation of Market Value of a Land

- Market Value are on the basis of State Government studies and its also scientific in nature. Market value focuses on the lowest rate for property in an area to be sold for. Here in the Guidance value minimum amount for a property to be sold or registered in a particular area. In a Guidance Value property shouldn’t be sold with a amount lesser then Market value, this will create some consequences.

- IF a person buys a property lower then a actual prices fixed by the State Government Guidance Value then that person should register their property at the Market value fixed by the State Government and should pay the taxes according to the rules made by Market value of the locality.

- Also, if an Individual buys certain property in a Higher rate than a rate fixed by Market value set by Government of state. In that case an Individual will be free to register their property back to the actual fixed rate set by the state Government.

- The term Guidance value and its functions will change and vary from locality to locality. So its normal if person from another state couldn’t understand the term used by you.

- Guidance Value falls under different category of properties such as Agriculture land, Apartment in a Housing complex, an independent villa and plotted development.

- Guidance value rely on a development stage of a property. If a property is in a well developed area then its price will be higher and if a property is in a less developed area then its price will be lesser then a price in a Well developed area.

- In a Market value set by the State Government, sellers can sell their property at their own will with the amount they fixed. Buyers cannot control the procedures or they don’t have the rights to overpower a seller to sell their property at the Guidance value set by State Government.

Calculation of Stamp Duty & Registration Fee in West Bengal

According to the law, Land buyers should pay stamp during registration to the Government on minimum Guidance value. Although if the individual brought a property in a low price, its compulsory for individual to follow the rules and regulations provided by the State government. If the purchase price is much higher then a fixed rate stated by the State Government, then the Individual should pay stamp duty on a purchase price and not on a Market value.

Important Links

| Market Value of Land | Check Here |

| Market Value of Land with Structure | Check Here |

| Market Value of Flat / Apartment | Check Here |

| Stamp Duty & Registration Fee | Check Here |

Thus you can easily check your Land Market Valuation in West Bengal. If you have any questions, you can shoot us through the comments section provided below.

Good Luck!!